Equifax Vs CIBIL Vs Experian Vs Highmark Credit Score & Credit Report

Loading your search...

Equifax, TransUnion CIBIL, Experian, and CRIF Highmark are the four credit bureaus that compute credit scores in India. Here are the key differences between them.

Lenders like banks and non-banking finance companies rely on credit reports before approving your personal loan or credit card application. A credit report is computed by credit information companies which are also known as credit bureaus.

The credit bureaus collects, collates and aggregates data from its members (individual consumers and lending institutions) to provide information related to the credit history and creditworthiness of an individual. At present, there are a total of 4 credit bureaus in India. All credit bureaus in the country are licensed by the Reserve Bank of India (RBI).

What are Credit Bureaus?

Credit bureaus, also referred to as Credit Information Companies (CICs), are pivotal entities in the financial realm. They act as intermediaries, systematically gathering, managing, and distributing credit-related information for individuals and businesses.

What are the functions of Credit Bureaus?

The major functions of the are:

Their primary function is to provide crucial data for lending decisions made by various financial institutions like banks, mortgage lenders, and credit card issuers. Operating within a regulatory framework, credit bureaus are often overseen by financial regulatory bodies.

Who regulates the Credit Information Companies (CICs) in India?

In the Indian context, Credit Information Companies (CICs) are regulated by the Reserve Bank of India (RBI) under the Credit Information Companies (Regulation) Act, 2005. Consumers also engage with credit bureaus as customers, utilizing services that offer insights into their credit history. As per regulatory requirements, individuals are entitled to request a free full credit report, including the credit score, once a year.

Responsibilities of Credit Bureaus

- While bureaus provide the means for lenders and creditors to make informed decisions concerning loans, credit cards, mortgages, and other types of credit and financing.

- Credit bureaus are required to compile a thorough collection of credit-related data from different sources, such as banks and other financial institutions; lenders; collection agencies; and public records.

- Credit bureaus must maintain large databases of reported credit accounts and constantly update these databases with any changes to the credit accounts of individuals or businesses.

- Credit bureaus must generate detailed credit reports, which will contain a person's or company's complete credit history, including personal information, repayment history on all credit obligations, credit usage, and all inquiries made into the individual's or company's credit.

- Credit bureaus provide lenders with three-digit credit scores that are a numerical representation of an individual's or company's creditworthiness and are derived from the individual's or company's credit report.

Comparison of the 4 Credit Information Companies in India

- TransUnion CIBIL: Established in 2000 with Reserve Bank of India (RBI) license, CIBIL is India’s oldest and most well-recognised Credit Bureau. Also, CIBIL offers one free credit report with a score every year, with reports available automatically online after payment or a request upon instant delivery. CIBIL compiles extensive credit histories from banks and significant lenders and is often where lenders turn first for evaluating credit applications for Personal Loans, Home Loans and Credit Card applications.

- Equifax India: Equifax received its India license to operate as a Credit Bureau in January 2010. They also offer one free credit report with a score (annually) and instant online delivery after you authenticate yourself. Equifax will include both Individual and Commercial credit data, and has great depth of analytics, data segmentation and extensive reporting capabilities across all lending categories (including Microfinance).

- Experian India: Experian began its RBI licensing process in 2006 and received a license in 2010. Experian offers one free credit report with a score per year and will provide instant delivery of your report through their website. Experian also offers the Indian credit market access to international credit scoring models and international analytics. Often, Experian will place added weight (points) on recent behaviours in scoring. Many FinTech and Digital Lenders favour Experian due to that lender’s dynamic scoring updates.

- CRIF High Mark: This was established in 2007 and received its RBI license in 2010, offering one complimentary credit report and score annually. Reports are emailed instantly after payment. CRIF High Mark serves all types of borrowers, from individual consumers to MSMEs (Micro, Small and Medium Enterprises) and commercial borrowing. It also provides banks, lenders, lenders’ customers and other financial institutions with analytics, solutions and software to assist them in lending.

Parameter | TransUnion CIBIL | Equifax India | Experian India | CRIF High Mark |

Year Established / RBI Licence | 2000 RBI licensed CIC | 2010 RBI licensed | 2006 RBI licence 2010 | 2010 RBI licence |

Credit Score Range | 300 to 900 | 300 to 900 | 300 to 900 | 300 to 900 |

Free Annual Report | One free report with score per year | One free report with score per year | One free report with score per year | One free report with score per year |

Report Delivery | Online instant, offline around 7 days | Online instant, offline 7–10 days | Online instant, offline up to 20 business days | Online instant after authentication |

Data Sources | Banks, NBFCs, major financial institutions | Banks, NBFCs, MFIs, commercial lenders | Banks, NBFCs, telecoms, utilities | Banks, NBFCs, MFIs, commercial lenders |

Update Frequency | Monthly from lenders | Monthly from lenders | Monthly with frequent dynamic updates | Monthly from lenders |

Core Focus | Widely used by banks for personal loans, credit cards, housing finance | Analytical depth, portfolio insights, consumer and commercial credit | Global predictive models, used in fintech and digital lending | Retail, MSME, and commercial segments with predictive analytics |

Special Features | Large historical database, widely referenced | Risk scoring, fraud management, segmentation | Analytics, customer engagement, predictive models | Business credit scores, microfinance reports, analytics, collections management |

Score Calculation | Proprietary algorithm | Proprietary algorithm with segmentation | Proprietary algorithm with global analytics | Proprietary algorithm with commercial and retail focus |

Score Interpretation | 700 and above considered good | 700 and above considered good | Above 750 considered very good | 700 and above considered good |

Dispute Resolution | Online and offline | Online and offline | Online and offline | Online via registered contact |

Typical Use by Lenders | Traditional banks and housing finance companies | Consumer and commercial credit decisions | Digital and fintech lenders | MSME, microfinance, and retail lending |

Notes | Oldest bureau with extensive credit histories | Known for analytical depth and data segmentation | Weighs recent credit behaviour heavily | Focus on broader borrower coverage including commercial and microfinance sectors |

Similarities Between the Credit Bureaus

- All four credit bureaus in India are licensed by the Reserve Bank of India (RBI).

- Lenders, including banks and NBFCs, share credit information with all credit bureaus equally; they do not differentiate between them.

- Each bureau uses its own algorithm to calculate credit scores.

- Credit scores from all bureaus are considered valid for lending purposes.

- Despite differences in algorithms, the five key components considered while calculating a credit score are the same across bureaus:

- Repayment history

- Type of credit

- Age of credit

- Credit exposure

- Credit inquiries

- Credit scores from different bureaus may differ slightly.

- A marginal difference of around 50 to 60 points between bureaus is commonly observed and accepted by lenders.

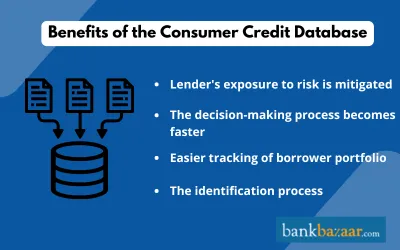

Benefits of the Consumer Credit Database

The Consumer Credit Database offers several benefits to lenders:

- Lenders have less risk when using this database. Lenders can look up a customer's credit inquiries and trade lines throughout their credit history to determine if the customer is trustworthy and how much risk they are taking on.

- Lenders can make faster, more accurate lending decisions using the credit scores and Credit Information Reports provided through this database. With these two pieces of information, lenders have a good idea of the customer's ability to pay both in the short and long term.

- A central repository of borrowers allows lenders to regularly assess their borrowers' performance, ensuring timely adjustments and better portfolio decisions.

- The consumer credit database contains extensive data, often used in conjunction with government databases like PAN and Aadhaar, which makes it easy for lenders to verify the identity of their customers.

Disclaimer

Display of any trademarks, tradenames, logos and other subject matters of intellectual property belong to their respective intellectual property owners. Display of such IP along with the related product information does not imply BankBazaar's partnership with the owner of the Intellectual Property or issuer/manufacturer of such products.

Read More on Equifax

- Enhanced Credit Information Report

- Basic Equifax Credit Information Report

- How to Apply for Credit Score

- How to Maintain Healthy Credit History

- Equifax ePort

- Register with Equifax ePort

- Equifax Credit Score Vs CIBIL Credit Score

- How does Equifax verify your ID?

- Product and Services Offered by Equifax Consumer Bureau

Know More About CIBIL

TransUnion CIBIL is one of the leading credit information companies in India. The company maintains one of the largest collections of consumer credit information in the world. CIBIL Score plays a key role in the lives of consumers. Banks and other lenders check the CIBIL Score of the applicants before approving their loan or credit card application. Consumers can visit the official website of CIBIL to check their CIBIL Score and Report.

FAQs on Equifax Vs CIBIL Vs Experian Vs Highmark Credit Score and Credit Report

- What is the meaning of Hallmark of Highmark credit score?

The summary of the credit history in the numerical format is called Highmark credit score.

- Why does the credit score vary depending on the bureau?

The credit score is different because of the algorithm that is used by each bureau.

- Is the credit score provided by different bureaus valid?

Yes, the credit score provided by different bureaus are equally valid.

- What is the main difference between Experian and Equifax?

The information that is collected and the way it is reported is the main difference between Experian and Equifax.

CIBIL Score Requirements for Loans

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.